Sommelier Finance Case Study

Campaign Overview

Sommelier Finance, a decentralized finance (DeFi) platform, needed to attract high-value DeFi investors to help boost their liquidity pools. To achieve this, the Sommelier Finance team ran a campaign using the advanced targeting features on Blockchain-Ads. The 30-day investor acquisition campaign was designed to increase liquidity in specific pools on the Sommelier platform with a total ad spend of $100,000.

Strategy

The comprehensive strategy included:

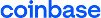

- Audience Targeting: Focused on DeFi Protocol Users and High Net Worth Individuals interested in Personal Finance and Investing to reach sophisticated investors actively participating in decentralized finance ecosystems.

- Multi-Chain Approach: Leveraged cross-chain targeting to reach investors across Ethereum, Solana, Tron, Binance Smart Chain, Fantom, and Polygon networks.

- Personalized Funnel Strategy: Built awareness, engagement, and acquisition through tailored messaging at each stage to maximize investor interest and conversions.

- Strategic Retargeting: Re-engaged users who had shown interest but hadn't yet contributed to Sommelier's liquidity pools, offering customized incentives to complete their investment.

Results

The campaign delivered exceptional outcomes for Sommelier Finance:

- New Investors: 10,430 new liquidity pool investors were acquired.

- Added Liquidity: $7,000,000 in new liquidity was generated.

- Return on Ad Spend (ROAS): An impressive 70x ROAS was achieved.

Execution

- Targeting DeFi Protocol Users ensured access to experienced investors familiar with liquidity provision strategies.

- High Net Worth Individual targeting attracted investors with significant capital allocation capabilities for maximum impact.

- Personal Finance and Investing interest alignment reached sophisticated investors seeking diversified DeFi yield opportunities.

Insights & Learnings

Sommelier Finance successfully scaled their liquidity pools through strategic audience targeting and comprehensive campaign execution. The combination of DeFi Protocol Users and High Net Worth Individual targeting delivered exceptional results within 30 days. This case study demonstrates how precise behavioral targeting can attract high-value investors and generate substantial liquidity growth for DeFi platforms.

Get Started Now

Sign up to become an affiliate today

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)